Today begins our one-week spending freeze as part of the #MoneyBoost challenge with Experian for September! Each week we will be focusing on attainable, financial goals that we can do together!

How does a spending freeze work?

First off, this spending freeze is only one week long. Why? I (Brooke) have done month-long spending freezes before and it can be a little daunting. Because we want everyone to join us on this we thought a week would be a good length for a lot of people’s first time trying a spending freeze.

What are the rules of the spending freeze?

The rules of the spending freeze are simple. You must not spend money on anything but the necessities of food, water, and gas for your car. That means no perusing the home decor section at Target or getting late-night cookies delivered.

Are there any exceptions to the rules?

Of course! Use your best judgment. If your mom’s birthday is this week then I would encourage you to get her a thoughtful gift (maybe partly homemade if you can!) Parker and I will be traveling to Las Vegas the last day of the spending freeze and I have already arranged discount tickets to a show and he got a gift card for a special dinner out so that we can stick with our spending freeze until the very end!

Remember that it is not forever

The point of a spending freeze is to see where your money is going. It is interesting to take a step back for a week and see the impulse buys that you have to skip. For me it is going out to lunch, holiday decor, buying clothes for Lila (they are just so cute!), and the entire Trader Joe’s treat section ha.

The end goal

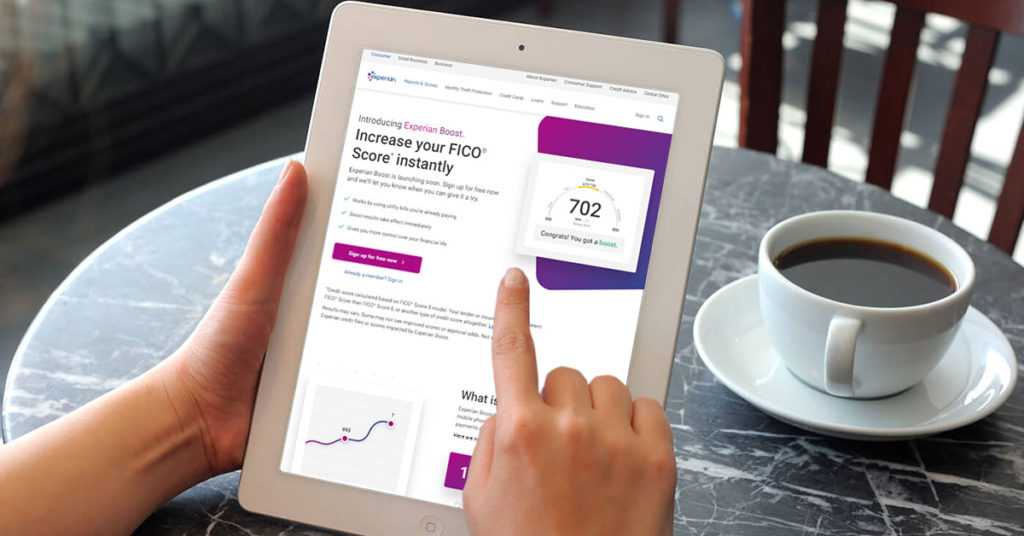

Remember the end goal while doing the spending freeze. Our September challenge is to become financially fit. That means long-term consequences for our bank accounts that we will LOVE! Download the Experian Boost app if you haven’t yet and get working with the free tools that they offer. It is definitely a game-changer!