The challenge is coming to a close

The September #MoneyBoost Challenge with Experian is coming to an end. This month has flown by and we have learned a lot about our finances along the way!

We have had a different focus each week

- We announced the #MoneyBoost Challenge during the first week of September and how Experian is the first step to getting financially fit. The app is user-friendly and incredibly easy to use.

- The second week of September was all about the spending freeze! We stopped all unnecessary spending for an entire week. The goal of the spending freeze was to see where all of your money actually goes.

- The third week of the challenge was focused on getting your finances in order: Now is the time to sign up for the credit card that will get you the best rewards or refinance your house while rates are low. Do the things that you have been meaning to do for years.

- This last week of the month we will be sharing some money tools that we love to use and how they can be easily incorporated into your daily life. Obviously, you will want to start with the Experian Boost app.

Money tools that we love

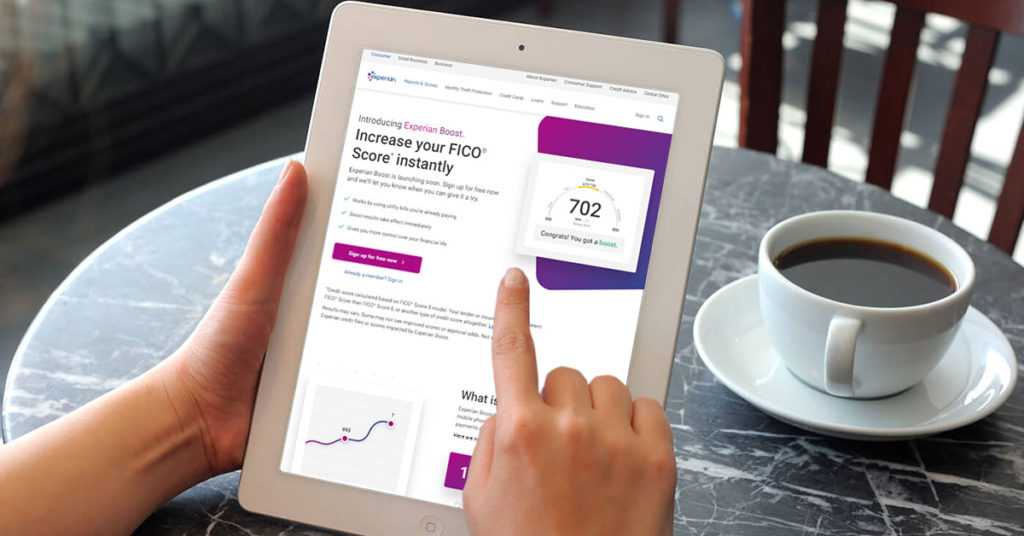

Obviously, we love the Experian Boost app. It is perfect for someone looking to buy a house or get a new car. The app helps you understand your credit score better, which is something that we could all use! Go to the app store and search Experian Boost to download the app.

Excel spreadsheets

After you sign up for the Experian Boost app and look through all the resources it can be nice to put the info into a spreadsheet. Both of our husbands happen to LOVE spreadsheets so have gotten used to doing things this way.

Monthly Budget

Writing out a monthly budget can be really helpful (and a little scary if we are being honest). However, it is nerve-wracking to not have any idea how much you actually spend each month so we highly recommend writing things out in a spreadsheet. You can add in fun categories like birthdays and vacations. This way you can be saving for them every month.

Financial gurus

When you are trying to improve something in your life it is helpful to look at those wiser than you to see how they do things. This is where financial gurus come into play. Some of our favorites include:

- Dave Ramsey: Although some of his methods are extreme we love his tagline, “Live like no one else so that one day you can live and give like no one else.”

- Fun Cheap or Free: Jordan has some great ideas when it comes to keeping things affordable when you have a family – she has 6 kids with twins on the way!

- Experian Blog: This is an incredible resource for anyone that is looking for accurate and up-to-date financial information and tips. One of our favorite blogs from them recently is “7 Best No-Fee Rewards Credit Cards”. Read it and start racking up those points!

Check them out and let’s finish this challenge strong together!